- ai

- cryptography

- defi

2024 Crypto Meta-Analysis

Sam Green •

Sam Green • This article was co-authored with Alexander Garn. Thanks to Yuri Papadin and Ahmet Ozcan for reviewing this article.

Introduction

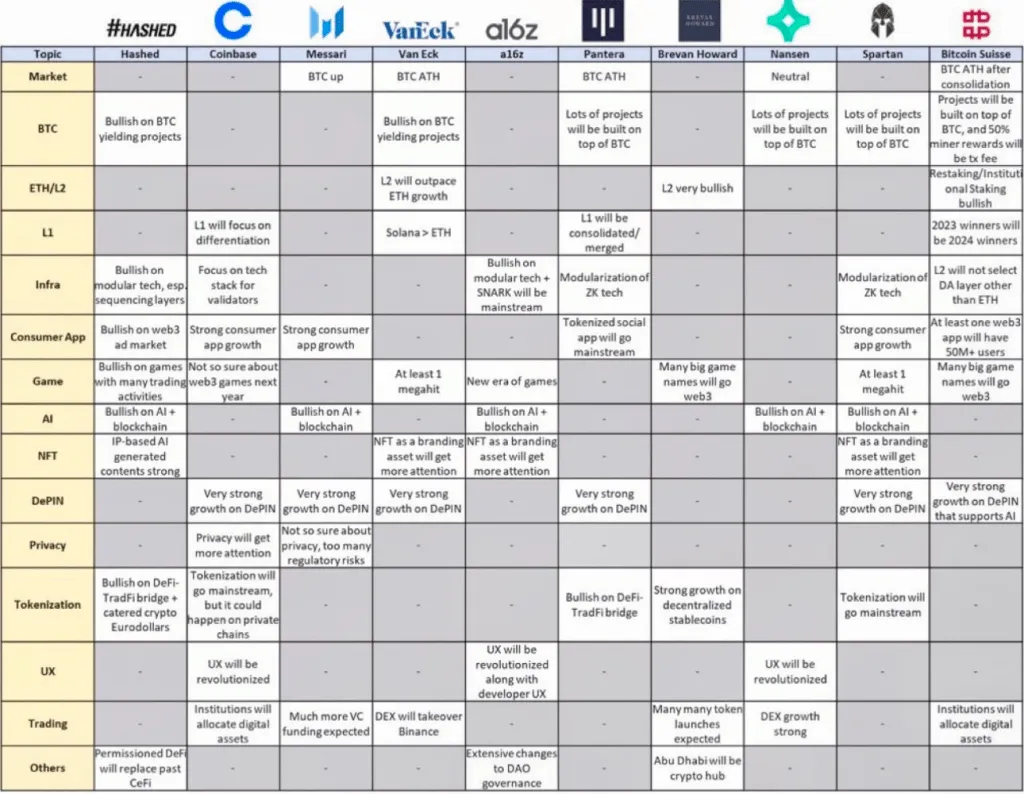

Many groups have released 2024 crypto market outlooks this year. We used ChatGPT to summarize those from Messari, VanEck, Pantera Capital, Coinbase Institutional, and a16z crypto. We also include outlooks from Odos, a leading DeFi aggregator, and intent solver spun out of Semiotic. These organizations represent diverse views, including research and analytics, global investment, blockchain asset management, institutional crypto trading, venture capital investment, and DeFi aggregation. The first half of this article provides perspectives on common themes, including Bitcoin, DeFi, web3 gaming, AI, DePIN, UX, NFTs, and DeSoc. The second half of this article links to the original reports and highlights selected perspectives that don’t fall under the common themes.

Table of Contents

Common Themes

The most common themes are Bitcoin, DeFi, Gaming, Decentralized Social Media (DeSoc), AI, Decentralized Physical Infrastructure Networks (DePIN), improving user experience, and tokenizing real-world assets (RWAs).

Bitcoin

Across the reports, there is a uniform view that Bitcoin’s dominance is expected to persist, driven by growing institutional interest and validation as a unique digital store of value and inflation hedge. The upcoming halving event is highlighted as a potential catalyst for appreciation. However, near-term pressures from events like Mt. Gox distributions and FTX liquidations may create volatility.

There is excitement around a Bitcoin ETF. An ETF (Exchange-Traded Fund) is a type of investment fund and exchange-traded product, i.e., they are traded on stock exchanges. ETFs are similar to mutual funds but are listed on exchanges, and ETF shares trade throughout the day just like ordinary stock. Some ETFs track an index of assets, like a stock index or bond index. As of late 2023, the U.S. Securities and Exchange Commission (SEC) indicates a potential change in stance regarding approving spot Bitcoin ETFs. Officials met with representatives from several companies, such as BlackRock and Grayscale Investments, instructing them to make final application changes with an anticipated approval of several ETFs early in 2024. This marks a significant shift from the SEC’s previous rejections of spot Bitcoin ETFs, citing market manipulation risks. The recent developments are driven by increasing signs of regulatory openness and possibly a recent federal court decision, which found the SEC had erred in a past rejection. The industry expects the SEC to give multiple applications a green light simultaneously.

DeFi

DeFi / Messari

DeFi represents just under 0.01% of the $510 trillion value of global financial assets, indicating significant room for expansion. The report highlights DeFi’s resilience under stress conditions, citing its performance during major crypto events like the collapse of Luna and FTX and the freezing of the U.S. banking system. The report also mentions that according to the IMF, DeFi applications have the lowest marginal cost of capital, which is three times lower due to reduced operational costs.

Despite this, the report acknowledges a shift towards more regulated DeFi, suggesting that many top projects are preparing for rigorous oversight. It posits that while this might seem like a re-intermediation of finance, a better view is to consider DeFi as a bridge in a post-regulation age. This bridge would allow jurisdictions requiring more intermediation for regulatory reasons to treat front-end operators like financial intermediaries while enabling Wall Street to start utilizing these platforms. The report concludes by likening the move towards a more regulated DeFi to a gradual, multi-decade technical upgrade similar to the financial industry’s adaptation to the internet.

More details:

-

RWA Diversification: Real World Assets (RWAs) on public blockchains are expected to be significantly driven by DeFi natives rather than traditional finance.

-

Preference Trends: There’s an anticipated preference for platforms like Coinbase over traditional financial institutions like JPM for diversifying into other assets.

-

Bitcoin’s Layer 2 Ecosystem: The report highlights Bitcoin’s vibrant Layer 2 ecosystem led by Stacks, which is expected to provide better access to Bitcoin liquidity and security with fewer trust assumptions. This also includes developments in rollups on Bitcoin and indicates a broader integration of Bitcoin with other DeFi and financial applications.

-

Creator Economy: Traditional social platforms capture significant revenue, and the report suggests that DeFi and blockchain can provide alternatives where creators retain more value, showing the economic shift towards more equitable models favored by DeFi principles.

-

Fan Economy & Exclusivity: friend.tech, a platform that allows users to create and join exclusive private chat rooms, showcases how DeFi concepts like bonding curves are being applied beyond financial products to social and fan-based applications, indicating the broadening scope of DeFi’s impact.

-

Token Bound Accounts: The evolution of NFT marketplaces to accommodate dynamic assets, like Token Bound Accounts (TBAs), represents an advancement in how DeFi can support complex ownership and trading models.

-

Decentralized Storage: Decentralized storage networks are growing rapidly, offering cost-effective alternatives to traditional cloud providers like Amazon S3, and are an integral part of the infrastructure that DeFi applications can build upon.

DeFi / VanEck

The report anticipates that KYC-enabled and walled garden apps, such as those using Ethereum Attestation Service or Uniswap Hooks, will gain substantial traction, potentially approaching or even surpassing non-KYC applications in user base and fees. This movement is expected to drive institutional liquidity and volume to protocols like Uniswap by enabling new entrants to participate in DeFi without interacting with OFAC-sanctioned entities. The introduction of hooks will reinforce Uniswap’s competitiveness and drive token appreciation, particularly once the DAO votes in favor of activating the Uniswap Protocol fee switch, which is expected to be no higher than 10 basis points.

Other details:

-

Post-EIP-4844, Ethereum’s upgrades are expected to significantly reduce transaction fees and improve scalability, consolidating dominant players in the Layer 2 space and increasing their transaction volume and total value locked.

-

Binance is expected to lose its top spot in spot trading volumes due to regulatory challenges and the rise of competitors, with implications for the broader ecosystem of centralized exchanges.

-

DEX Market Share Growth: Decentralized exchanges are expected to increase their share of spot trading, driven by improvements in blockchain technology and increased adoption of self-custody solutions.

-

New use cases for Bitcoin, particularly in remittances and as collateral in various DeFi protocols, are anticipated to emerge, creating new yield-generating opportunities.

-

Solana’s Performance and DeFi TVL: Solana is predicted to outperform Ethereum and other blockchains in market cap, total value locked, and active users, partly due to advancements in its ecosystem and technology.

DeFi / Pantera Capital

Bitcoin and the overall cryptocurrency market capitalization have seen significant rebounds since the start of the year, with the market capitalization of cryptocurrencies doubling from $0.8 trillion to $1.6 trillion.

The report mentions key legal wins, such as Ripple’s native token XRP being ruled not a security and Grayscale’s legal victory against the SEC regarding their Bitcoin ETF application. These are seen as positive steps toward a favorable regulatory landscape for blockchain in the U.S.

DeFi / Odos

L2s Capturing DeFi: Throughout 2023, we saw significant adoption of (and value transferred to) L2 ecosystems with notable events such as the Arbitrum airdrop, full launch of zkSync Era and Base, as well as major updates and announcements of new L2s such as Scroll, Linea, and Polygon zkEVM. Looking ahead to 2024, as the adoption of these L2s continues, we see users bringing massive amounts of liquidity and a slow but consistent transfer of DeFi activity from Ethereum Mainnet to these L2s. As they mature and prove their security models, we anticipate a significant share of all DeFi activity will begin to take place on L2s driven by the cheaper gas fees.

Rise of On-Chain Order Books: A very early movement we’ve observed picking up momentum into 2024 is the rise of on-chain order books. On-chain order book protocols can only sustainably exist on much cheaper blockchains, such as the L2s discussed above, and are an exciting “L2 native” evolution of DeFi. We have heard concerns that on-chain order books will replace or out-compete automated market makers (AMMs), but we don’t believe this will take shape. DeFi’s success has been largely driven by the composability of protocols and a diverse and innovative landscape of protocols to choose from. On-chain order books will be an additional dimension to DeFi, adding value, specifically to L2s.

Liquid Token Trading Firms Expand: Each year, the crypto community, specifically DeFi, discusses the inevitable entrance of institutions that will bring billions of trading volume. As we await this more formal and restricted set of investors, we have seen an uptick heading into 2024 of advanced trading firms specializing in on-chain strategies. These firms will be incredibly active next year if activity picks up and should be a catalyst for DeFi protocols they leverage to trade and capture yield.

Gaming

Gaming / Messari

The report highlights approximately 3.44 billion gamers globally, contributing to an expected $184 billion in revenue for the gaming industry in 2023. This number is anticipated to continue increasing. Gen Z and Gen Alpha are particularly engaged, spending around 15 hours a week gaming and having spent $135 billion in 2022 on virtual gaming items. The report notes a key trend where younger gamers increasingly demand actual ownership of virtual goods, signaling a shift from today’s prevalent models where game items are not truly owned or freely tradeable.

Gaming / VanEck

The report predicts that blockchain gaming will see a title surpassing 1 million daily active users, demonstrating the potential of blockchain in the gaming industry.

Immutable X is highlighted as a likely candidate to become a top 25 coin by market cap, associated with the release of high-budget games like Illuvium and Guild of Guardians. Immutable is noted for designing a token that better aligns interests than most and has been building multiple AAA games set for release in 2024.

Immutable has been working on resolving many technical pain points that have previously hindered the success of web3 gaming, such as wallet management. Immutable’s Passport is expected to allow users to log in to games and manage their blockchain-based game items with a familiar single sign-on process while abstracting away the more complex blockchain interactions.

The WAX blockchain is mentioned as leading the gaming sector with many daily unique active wallets, primarily playing games like Alien Worlds. However, the report also indicates a caveat that many players in such games might be bots.

Gaming / Coinbase Institutional

The report suggests that web3 gaming has seen renewed interest in the second half of 2023 after a decline earlier in the crypto winter. The gaming sector, a significant portion of the entertainment industry, currently boasts a total addressable market of approximately $250 billion, with expectations to grow to $390 billion over the next five years. Despite the vast opportunities, the report notes skepticism towards the “play-to-earn” models exemplified by early projects like Axie Infinity, which has led to broader disapproval among mainstream gamers.

The report indicates that this skepticism fosters innovation, with developers experimenting to merge high-quality game design with viable financial mechanics, such as minting web3 primitives like non-fungible tokens (NFTs) for use, transfer, or sale in-game or on designated marketplaces. However, most gamers reportedly dislike NFTs, reflecting a rejection of the play-to-earn or pay-to-play models. The gaming industry sees value in leveraging web3 architecture to enhance user acquisition and retention potentially, but this benefit remains unproven. With many projects approaching significant milestones in their development cycle, the release of some web3 games in 2024 is expected to provide better insight and data to assess this sector’s potential.

AI

AI / Messari

The document emphasizes the significance of hardware in the AI revolution, highlighting the role of decentralized GPU marketplaces like Gensyn. These marketplaces are portrayed as solutions to the imbalance between the short supply and increasing demand for GPUs needed for AI model training, creating a decentralized supercomputer network. Another project, Bittensor, is mentioned as a platform incentivizing the creation and sharing of machine intelligence, enabling individuals to contribute to open-source AI and monetize their work.

The convergence of AI and crypto is seen as expanding the design horizons of crypto, with three key synergies highlighted:

-

AI agents utilizing crypto infrastructure: AI can autonomously use digital resources such as storage, compute, and bandwidth made available through crypto infrastructure.

-

zkML innovations: These allow smart contracts to query AI models securely, thus expanding the capabilities inherent to blockchains.

-

Tokenization for rewarding contributions: Tokens are seen as a way to reward individuals for fine-tuning AI models and collecting valuable real-world data intersecting with DePIN.

AI / a16z crypto

The report suggests that AI, as exemplified by models like ChatGPT, is predominantly in the realm of tech giants due to significant compute and data requirements. Decentralized blockchains are seen as a critical counterbalancing force.

-

AI in Gaming and Web3: AI is poised to revolutionize gaming, not just in gameplay but in governance and operational integrity. With AI-generated game elements, the need for guarantees about the neutrality and integrity of these elements becomes crucial. Crypto technology is highlighted to offer such guarantees, ensuring the fairness and credibility of AI-generated content in gaming.

-

NFTs and AI: Integrating NFTs into mainstream brand strategies is highlighted as a growing trend with potential implications for AI. As brands increasingly adopt NFTs for identity, community, and customer engagement, there’s an implication that AI could play a role in creating, managing, or personalizing these digital assets, especially as they become more interactive and complex.

-

SNARKs and AI: SNARKs are mentioned as an emerging technology with the potential to verify AI computations and enhance the integrity and privacy of AI operations.

DePIN

DePIN (Decentralized Physical Infrastructure Networks) is an approach to building and maintaining infrastructure in the physical world, such as WiFi hotspots and solar-powered batteries. It leverages widespread Internet connectivity, blockchain infrastructure, and cryptography to enable a decentralized build-out by individuals and companies globally. Participants in DePINs receive financial compensation and ownership stakes through token incentives.

DePIN / Messari

DePIN encompasses storage, computing, wireless connectivity, energy networks, and geospatial data collection. It operates through two main branches: Physical Resource Networks (PRNs) and Digital Resource Networks (DRNs). PRNs deploy location-dependent hardware for resources like energy and connectivity, while DRNs provide a location-independent backend for the cloud, focusing on digital resources like compute, storage, and bandwidth.

The report highlights the increasing demand for DRNs, noting the vast potential for adoption. The cloud storage market is substantial, valued at $80 billion and growing by 25% annually, yet decentralized alternatives cater to less than 0.1% of this market despite offering costs 70% lower than traditional providers like Amazon S3. This gap indicates a significant opportunity for expansion and market penetration by DePIN solutions.

Specific decentralized storage providers are mentioned, including:

-

Filecoin: Primarily provides cold storage solutions, focusing on cost-effective archival data storage. It’s recognized for its capacity and utilization rates, making it a dominant player in the storage network.

-

Storj: Known for hot storage solutions with fast retrieval times, targeting enterprises with compatibility to Amazon S3, particularly utilized in the media and entertainment industries.

-

Sia: Targets developers with its private storage solutions and is known for quick retrieval times in the hot storage market.

-

Arweave: Attracts NFT, metaverse, and decentralized social projects with its “pay once, store forever” model. It’s expected to see a significant increase in demand over the coming years.

The report underscores that most businesses are unlikely to return to managing complex hardware setups in-house but are also wary of relying entirely on centralized Big Tech vendors.

DePIN / VanEck

The outlook report appears to have a positive yet cautious perspective on DePIN. Specifically:

-

Meaningful Adoption of DePIN Networks: The report predicts that in 2024, multiple DePIN networks will see meaningful adoption and capture public attention. The focus seems to be on networks that leverage decentralized contributions to map or provide services traditionally dominated by centralized entities.

-

Hivemapper’s Growth: It specifically mentions Hivemapper, a decentralized mapping protocol, aiming to be a community-owned alternative to Google Streetview. The report anticipates that Hivemapper will map its 10 millionth unique kilometer, surpassing 15% of global road capacity. This signifies a substantial growth and adoption rate, implying a speed and cost-of-capital advantage over traditional mapping services like Google. Hivemapper incentivizes contributors with its native token, [$HONEY](https://coinmarketcap.com/currencies/hivemapper/), to expand its database, indicating a successful utilization of crypto-economic principles to fuel its network growth.

-

Helium’s Expansion: Helium ($HNT) is a decentralized network of wireless hotspots. The report foresees Helium reaching 100,000 paying subscribers for its nationwide US 5G plan, up from the current count. Helium’s model allows anyone to set up hotspots and earn crypto tokens, showcasing a significant move towards decentralized infrastructure in telecommunications. The model’s benefits include being capital-light for Helium and turning hotspot providers into network advocates due to their ongoing stake.

-

Market Implications: The implication of these networks’ growth is significant in terms of disintermediating legacy providers and potentially reducing costs. For example, Helium claims to deliver data at less than 50% of the cost of legacy networks.

User Experience (UX)

UX / Coinbase Institutional

Coinbase Institutional emphasizes the challenge of managing crypto assets, given the complexities involved, such as handling wallets, private keys, and gas fees, which can deter wider adoption. To address this, the industry is making the technology more user-friendly and accessible. A notable advancement in this direction is the progress around account abstraction, especially with Ethereum’s introduction of the ERC-4337 standard in March 2023, simplifying user experience by treating externally owned and smart contract accounts similarly. This allows for more flexible transaction funding, including institutional entities acting as “paymasters” to cover transaction fees, and potentially supports “gasless transactions” that lower the entry barrier for new and existing users.

More details:

-

Account Abstraction: Aimed at simplifying crypto interactions by similarly treating externally owned accounts (like wallets) and smart contract accounts. Ethereum’s introduction of the ERC-4337 standard in March 2023 represents a significant step in this direction, offering new opportunities for user interaction and engagement. ERC-4337 also allows application owners on Ethereum to act as “paymasters,” covering the gas fees for users or enabling users to fund transactions with non-ETH tokens. These features appeal to institutional entities that prefer not to hold gas tokens due to their price variability or other concerns.

-

Project Guardian & J.P. Morgan’s Involvement: A proof-of-concept report from J.P. Morgan as part of Project Guardian illustrates the practical applications of these advancements. It highlights all gas payments handled via Biconomy’s Paymaster service, indicating the industry’s shift towards more user-friendly transaction processes.

-

Dencun Upgrade: This upcoming upgrade is expected to reduce rollup transaction fees by 2-10 times. The report suggests that this could lead more decentralized applications (dapps) to pursue a “gasless transactions” model, allowing users to focus only on high-level interactions and possibly enabling new non-financial use cases.

-

Robust Wallet Recovery Mechanisms: Improving user experience involves creating failsafes against common issues like losing a private key. Account abstraction can facilitate such robust wallet recovery mechanisms, further reducing the barriers to entry for new users and enhancing the overall security and usability of crypto assets.

UX / Odos

Intents: 2023 has set the stage for launching a new class of intent-based products in 2024. A very early but hot narrative expanding beyond DeFi is centered around “Intents” as a new paradigm for defining actions on a blockchain. Previously, users defined and executed specific transactions. Intents allow users to more abstractly define a goal to achieve, even if they don’t know how to get there, such as: “I want to swap ETH into USDC; find me the highest output”. Without the user needing to find many venues, compare rates, and explore arbitrage opportunities across other assets, it becomes clear what the UX improvements intents can provide. Combining these composable user objectives with other ongoing efforts, such as account abstraction, redefines crypto UX for the better.

NFTs

NFTs / Messari

The report highlights how Blur impacted the Ethereum NFT ecosystem by introducing a trader-friendly user experience and innovative lending products like Blend. These changes directly challenged OpenSea’s dominance and stirred mixed reactions due to the aggressive tactics employed. Despite some controversy, the report asserts that the building blocks provided by Blur are crucial for the long-term vibrancy of the NFT market. The perspective is optimistic about the future of NFTs.

The report discusses another NFT-related development under “Project Guardian,” described as the best-looking “Crypto Mullet of 2023.” This initiative is a collaboration between traditional financial institutions like JPMorgan and Apollo with blockchain entities such as Avalanche, LayerZero, Axelar, and Oasis Provenance. The project aimed to create a product for TradFi that allows asset managers to tokenize funds and better manage rules-driven active portfolios. The significance of Project Guardian lies in its technological capability, indicating that the technology not only works but might be offered in a regulatory-compliant manner.

NFTs / VanEck

The report predicts a significant resurgence in NFT activity, projecting that monthly volumes will approach new all-time highs due to several factors: As crypto markets revive, speculators are expected to return, bringing liquidity and trading volumes to the NFT market.

-

Improvement in Crypto Games and Platforms: The report indicates a development in the quality and appeal of crypto games and platforms supporting NFTs.

-

The emergence of Bitcoin-based NFTs: While Ethereum has historically dominated the NFT market, the report highlights the growing role of Bitcoin in the NFT space, particularly through its Ordinals protocol and emerging Layer 2 solutions. This development is expected to diversify the NFT landscape and contribute to a rebirth in Bitcoin network fees. By the end of 2024, the ETH-to-BTC primary NFT issuance ratio is anticipated to narrow to approximately 3-1, indicating a substantial increase in Bitcoin’s NFT activities.

-

Stacks (STX) Growth: Stacks, a smart contract platform that leverages Bitcoin’s security, is expected to rise significantly in market capitalization, becoming a top-30 coin. This growth reflects the broader market’s increasing interest and investment in Bitcoin-based NFTs and related infrastructure.

NFTs / Coinbase Institutional

The report discusses the trend toward modular blockchains like Celestia. It indicates that NFTs are part of this trend as the blockchain technology landscape evolves to cater to more specialized needs.

NFTs / a16z crypto

Starbucks has introduced a gamified loyalty program involving digital assets, while Nike and Reddit have developed digital collectible NFTs aimed at broader audiences. This trend signifies a shift toward integrating NFTs into everyday consumer interactions and branding strategies.

Brands are leveraging NFTs as marketing tools and as a means to enhance customer identity and community affiliations and even co-create products with enthusiasts. NFTs are seen as a bridge between physical goods and their digital representations.

The report highlights a growing trend of inexpensive NFTs designed for large-scale collection as consumer goods. This approach is often facilitated through custodial wallets or Layer 2 blockchains that offer lower transaction costs, making it more feasible for widespread adoption.

Going into 2024, the conditions are favorable for NFTs to become ubiquitous as digital assets across various companies and communities. The anticipated book by Steve Kaczynski and Scott Duke Kominers is expected to delve deeper into this phenomenon, suggesting a strong future trajectory for NFTs as integral to brand strategies and consumer interaction.

Decentralized Social Media (DeSoc)

Desoc stands for “decentralized social media,” referring to the movement within the crypto that aims to build social media platforms and applications on decentralized networks. The primary goal of DeSoc is to address issues in traditional social media networks, typically controlled by a single entity or a small group of entities. These issues include concerns over data privacy, censorship, algorithm transparency, and equitable revenue distribution.

DeSoc / Messari

-

DeSoc Platforms Progress: The report mentions several platforms making strides in DeSoc, including Farcaster, Lens, Yup (a DeSoc aggregator), DeSo, and XMTP, which has a significant integration with Coinbase.

-

Existential Need for DeSoc: It articulates that DeSoc is no longer a nice-to-have but is existential for maintaining free speech, particularly in the face of censorship and digital un-personing.

-

Key Factors Driving DeSoc:

-

Portable Social Graphs: DeSoc addresses the risk of losing a social network by allowing users to maintain their social graph across different platforms. For instance, 70% of Lens users interact with more than one app, indicating the growing acceptance of portable social graphs.

-

Anti-Censorship: It underscores the importance of anti-censorship to ensure unfettered crypto conversations, considering the increasing censorship on traditional platforms.

-

Control Over Algorithms: DeSoc allows more interfaces for developers and users to create and control their social media experience, including customized feeds.

-

Creator Cash: Traditional social platforms capture the majority of revenue, but DeSoc, leveraging crypto’s financial technology roots, offers a more equitable financial model for creators. friend.tech is noted for showing potential in leveraging economic incentives to onboard users.

-

Tokenizing Real-World Assets (RWAs)

Tokenizing real-world assets (RWAs) refers to converting rights to an asset into a digital token on a blockchain. RWAs include real estate, art, commodities, shares of companies, or even intangible assets like intellectual property or rights to revenues.

RWAs / Messari

Messari highlights the growing trend towards tokenizing real-world assets, especially in DeFi lending protocols. Specifically, the report notes a significant shift in MakerDAO’s reserve composition, moving towards tokenized treasuries, which have grown from $40 million in mid-2022 to nearly $3 billion today. This trend is significant for a few reasons:

-

Growth and Tokenization: The move towards RWAs captures yield-bearing stablecoin holdings at exchanges like Coinbase and DeFi lending protocols. This trend is part of a broader shift towards incorporating traditional financial assets into the blockchain space.

-

Safety and Global Scale: RWAs in DeFi lending platforms are considered safer and more scalable globally compared to CeFi services. They have demonstrated resilience against various crises in the financial markets and continue to operate transparently and efficiently.

-

Collateral and Yield Diversification: Liquid Staking Tokens (LSTs) have become a popular collateral type within these platforms. For example, in MakerDAO, LSTs constitute a significant portion of deposits. This diversification allows DeFi-native investors to leverage different types of yields and collateral, further enhancing the attractiveness of DeFi loans over CeFi alternatives.

More details:

-

Centrifuge’s Role: Centrifuge is highlighted as a leader in the RWA space. It has the highest token market cap, the highest market share by private loans outstanding, and the lowest ratio of default to active loans among the three leading RWA credit protocols (the other two being Maple and Goldfinch). Centrifuge has $250 million in active loans, primarily due to a significant partnership with BlockTower Credit and MakerDAO, where MakerDAO has issued DAI loans backed by real-world instruments managed by BlockTower.

-

Stellar’s Involvement: Stellar has generated interest from financial institutions for tokenized Treasury experimentation. Franklin Templeton’s $330 million tokenized Treasury initiative and WisdomTree’s smaller pilot are significant components of this, representing a large portion of tokenized Treasuries.

-

Christine Moy’s Influence: Christine Moy, who previously led JPMorgan’s blockchain team and now manages Crypto Data and AI Strategy at Apollo, is recognized for her deep integration of crypto and traditional finance. She was instrumental in the Apollo-JPMorgan “Project Guardian” proof-of-concept, involving several crypto projects.

-

Broader Trends and Concerns: The report discusses whether the early leads of these initiatives will translate into growth in 2024 or if the RWA movement is another false start.

RWAs / Coinbase Institutional

-

Significant Growth and Notable Developments: The report specifically mentions the growth of Maker RWA collateral to more than $3 billion, highlighting it as a significant example of institutional interaction with public chains.

-

Adoption and Technological Integration:

-

A surge in yield-seeking behavior due to higher front-end bond yields has led to increased demand for protocols tokenizing US Treasuries and a decline in interest for private credit protocols with higher default risks and lower liquidity.

-

The report mentions the use of specific tools and technologies, such as Uniswap V4’s hook-driven architecture and Coinbase’s Verified by Coinbase attestations, to facilitate on-chain tokenized US Treasuries, which either block US persons or require KYC verification.

-

-

Institutional Use Cases and Efficiency:

-

Institutions’ focus on capital market instruments is underscored, with a particular interest in bank deposits, money market funds, and repurchase agreements. The report notes the importance of instantaneous settlement in higher interest rate environments, where capital efficiency becomes much clearer.

-

Despite the shift towards a one-business-day settlement period (T+1) by May 2024, the report emphasizes reducing settlement times further in markets, transacting hundreds of billions to over a trillion US dollars daily.

-

-

Challenges and Constraints:

-

Most tokenization efforts are focused on permissioned chains and closed-source smart contracts, with dominant technology providers being Hyperledger, Consensys’ Quorum, Digital Asset’s Canton, and R3’s Corda. These efforts face challenges in interoperability and the risk of liquidity fragmentation.

-

The report cites J.P. Morgan’s use of multiple bridging technologies in November 2023 to demonstrate ongoing initiatives to address cross-chain liquidity constraints.

-

-

Regulatory Landscape and Compliance: Regulatory hurdles remain significant, with the market lacking established legal precedents and templates. The report, however, notes increasing regulatory clarity, particularly in the EU with the DLT Pilot Regime, which is expected to facilitate legal and technical advancements in 2024.

Selected Perspectives

This section of the article highlights selected perspectives from each of the outlooks.

Messari Outlook

Original report: https://messari.io/crypto-theses-for-2024. Also, here is a great Bankless interview where Ryan Selkis summarizes Messari’s outlook.

Investment Trends

Bitcoin (BTC) & Digital Gold: Messari posits a strong long-term case for Bitcoin, viewing it as a hedge against government fiscal irresponsibility and a beneficiary of digital transformation and periodic halving events. While short-term predictions are uncertain, the long-term bullishness is supported by Bitcoin’s fundamental scarcity and institutional interest.

Ethereum (ETH) & The World Computer: Ethereum’s investment case is compared more to financial networks like Visa or JPMorgan than gold or commodities.

The Resurgence of Private Crypto Markets: Many crypto fund managers are underperforming the market and facing significant challenges. Messari outlines the difficulties and risks inherent in the liquid crypto markets due to technical and counterparty risks, high transaction fees, and intense competition. It contrasts this with the private crypto venture markets, which it describes as being in a “veritable valley of death” due to various challenges, including decimated VC markets, impacts from fraud, regulatory crackdowns, and a shift in focus to AI as a more attractive sector in tech.

However, despite these challenges, the report expresses optimism for new crypto venture investors. They argue that funds with a 2023 vintage might outperform traditional markets in the medium to long term and possibly even outperform BTC/ETH benchmarks due to the anomalously low entry prices of the year.

Policy Meta: The report explores the broader implications of crypto policy, drawing parallels with the “Crypto Wars” of the 1990s and discussing the changing landscape of American hegemony and its impact on crypto regulation. Messari suggests a need for a strategic approach to elections and policy to ensure the crypto industry’s growth and freedom.

AI & Crypto, Money for the Machines: Messari argues that as AI proliferates, the need for crypto’s provenance, scarcity, and security features will become more pronounced, making crypto an integral part of the digital future.

Products to Watch in 2024

USDT on Tron: Tether, particularly on the Tron network, has been highlighted for its growing significance as a store of value and a payment mechanism, especially in developing countries. It represents a substantial part of the global stablecoin market and is being adopted for various use cases beyond mere trading vehicles.

BASE from Coinbase: Coinbase’s entry into the rollup market with BASE is mentioned as a significant development. BASE is praised for its user-friendly bridging experience and is seen as potentially pioneering in navigating users between centralized and decentralized services.

Celestia: Celestia provides data availability and consensus for modular blockchains. It’s a significant project due to its approach to reducing base layer congestion and costs for rollups and other networks.

Firedancer: Developed by Jump Crypto, Firedancer is a validator client for Solana to enhance scalability and performance. Messari highlights its potential to increase Solana’s transaction capacity and network throughput significantly.

Farcaster: Recognized for its clean Web2 social application feel, Farcaster uses a hybrid back-end architecture for identity management and social interactions. It’s seen as a promising venture in the decentralized social media space.

Lido: The Shapella upgrade in April led to a substantial increase in capital inflows into Ethereum staking as investors awaited the ability to stake with full redeemability and the flexibility of withdrawals. The report also discusses the risks associated with liquid staking, notably the potential for network security issues due to validation delays and the disincentive to hold ETH if LST liquidity eclipses ETH liquidity, leading to unpredictable outcomes.

CCIP (Chainlink’s Cross-Chain Interoperability Protocol): CCIP is lauded for its contribution to enhancing security and functionality in cross-chain transfers and communications. Messari highlights its early adoption and potential for growth in the interoperability space.

Blur, Blend, Blast: These are discussed as part of the evolving NFT market, focusing on Blur’s impact on the Ethereum NFT ecosystem and its approach to financializing NFTs.

Project Guardian: A collaborative effort involving JPMorgan and others, Project Guardian is noted for its potential to allow asset managers to tokenize funds and manage rule-driven active portfolios more effectively.

People to Watch in 2024

Larry Fink (BlackRock) & Cathie Wood (ARK Invest): Their involvement in cryptocurrency through their respective institutions significantly influences the market, especially considering BlackRock’s ETF applications and Wood’s position in the ETF application line.

Jeremy Allaire & Dante Disparte (Circle): Recognized for their roles in Circle, particularly in stablecoins and regulatory engagement.

Kristin Smith (The Blockchain Association) & Michael Carcaise (Fair Shake PAC): Noted for their roles in advocating and shaping policy in the crypto space, reflecting the industry’s ongoing efforts to navigate and influence legislative and regulatory landscapes.

Senator Elizabeth Warren: As a prominent critic and regulatory influencer, Warren’s stance and actions significantly affect the industry’s regulatory future.

Elon Musk: His influence spans beyond just technology and into the regulatory and cultural discussions surrounding crypto and its broader implications.

Michael Sonnenshein & Craig Salm (Grayscale): Messari discusses their roles and the speculative future of Grayscale amidst a tumultuous time for DCG and the broader crypto asset management industry.

Nic Carter & Matt Walsh (Castle Island Ventures): Nic Carter is known for his prolific writing and defenses of Bitcoin’s ethos, Proof-of-Work mining, and stablecoins. He became widely recognized for exposing issues within banking regulators, advocating for Proof-of-Reserves, and countering misleading narratives about crypto’s role in terrorist activities. Matt Walsh gained attention for revealing the backstory of the SEC “darling” Prometheus and warning about problematic accounting rules designed to hinder crypto custody by Wall Street firms.

Lucas Vogelsang (Centrifuge), Denelle Dixon (Stellar), and Christine Moy (Apollo): Recognized for their efforts in bridging traditional finance with the emerging crypto markets, especially in the context of real-world asset tokenization.

Dan Romero (Farcaster) & 0x Racer (friend.tech): Mentioned for their innovative work in decentralized social platforms.

Crypto Policy Trends

The Crypto Wars of the 90s: This period is a historical analog to today’s crypto policy challenges. Messari notes the grassroots rebellions against government overreach and encryption battles, pointing out that these might not repeat given the cultural changes in the U.S. It’s suggested that the original “cypherpunks write code” ethos from this era might be hard to replicate today due to more profound societal shifts. [Semiotic note: Vitalik posted a related article after the Messari report was released.]

Complacency and Cultural Shifts: Messari critiques the complacency of the Gen X and Baby Boomer generations, which might have contributed to a loss of civil liberties and an increased national security apparatus. The report suggests that Millennials and Zoomers might be less inclined to fight against these trends, having grown accustomed to a world of eroded civil liberties and pervasive surveillance. The cultural and constitutional shifts post-Patriot Act and post-COVID are significant factors in shaping attitudes toward privacy and security.

The End of American Hegemony: The report argues that some government officials believe that the liberal tech policies of the 90s were a mistake, leading to a scapegoating of technology for broader societal issues. There’s a criticism of the desire among some in the U.S. to emulate more controlled internet models like China’s. This trend is juxtaposed with the decline of American global dominance and the rise of rival powers, indicating a need for a new strategy focused on innovative electoral tactics.

VanEck Outlook

Original report: https://www.vaneck.com/us/en/blogs/digital-assets/matthew-sigel-vanecks-15-crypto-predictions-for-2024/

The authors anticipate a U.S. recession in the first half of 2024, detailing various economic indicators that suggest a downturn.

Changes in accounting standards are predicted to encourage more corporations to hold cryptocurrencies, with Coinbase anticipated to lead in revealing blockchain revenues.

Pantera Capital Outlook

Original report: https://panteracapital.com/blockchain-letter/a-year-of-progress/

Pantera emphasizes the importance of understanding market cycles, particularly the 1-Year HODL Wave, and suggests that we may be at the cusp of another significant growth period based on historical patterns. For investors, the letter implies a strategy of long-term engagement and vigilance for signs of cycle progression.

What is the 1-Year HODL Wave?

The “1-Year HODL Wave” refers to a metric that tracks the percentage of all bitcoins that have not been moved from one wallet to another for at least one year. The term “HODL” is a community-inspired acronym for “Holding On for Dear Life,” originating from a misspelled “hold” in a Bitcoin forum post. This metric is seen as an indicator of investor sentiment and behavior, often correlating with broader market trends.

Significance of the 1-Year HODL Wave

The 1-Year HODL Wave is used to gauge the long-term holding sentiment within the Bitcoin community. Here are some insights from the document regarding its significance:

-

Indicator of Market Cycle: When the percentage of bitcoins held for over a year decreases, it’s often a sign that long-term holders are starting to sell, typically occurring as bitcoin’s price approaches new cycle peaks. This decrease in the 1-Year HODL Wave coincides with increased market activity as more bitcoins become available for trading.

-

Historical Price Action: The document suggests that historically, as the 1-Year HODL Wave indicator reaches new highs, it correlates with market lows. The rationale is that a higher percentage of long-term holding reduces the tradeable supply of Bitcoin, potentially setting up a market upswing as the demand meets a restricted supply.

-

Predictive Nature: According to the letter, most price gains in a cycle historically come after the 1-Year HODL Wave indicator peaks. The document hints that if the past patterns hold, there might be significant gains ahead in the current cycle.

When the letter was written, the Pantera authors observed that the 1-Year HODL Wave did not clearly indicate that it had topped out for the current cycle. They correlated this with historical actions around the peaks of this wave to suggest that significant gains might still be ahead for Bitcoin. They also discussed how this wave’s peaks have historically aligned with Bitcoin halvings, suggesting a close watch on the next halving for potential market movements.

Coinbase Institutional Outlook

Original report: https://coinbase.bynder.com/m/c8c6fdc663f44b5/original/2024-Crypto-Market-Outlook-V3.pdf

Emerging Themes and Long-Term Outlook

Layer-2 scaling solutions have grown rapidly, with developments like OP Stack, Polygon CDK, and Arbitrum Orbit offering customizable rollups. Despite this proliferation, much activity remains on Ethereum’s mainnet, suggesting a complex interplay between L1 and L2 solutions.

Stablecoins and Regulation

The document outlines a complex and evolving regulatory landscape for stablecoins. In the U.S., there is no unified federal regulatory framework; instead, a mixture of state and federal regulations applies to different aspects of stablecoin issuance and use. The lack of comprehensive regulation creates uncertainty, hindering stablecoin market growth and technological innovation. Notably, the “Clarity for Payment Stablecoins Act of 2023” received bipartisan support, indicating a move towards more structured regulation.

Internationally, the European Union’s Markets in Crypto-Assets (MiCA) regulation stands out as one of the most comprehensive legal frameworks for crypto assets, including stablecoins. It sets stringent requirements for stablecoin issuers and aims to ensure the stability and security of digital assets across the EU. Other regions like the UAE, Singapore, and Hong Kong are also making significant strides in creating more broadly conducive regulatory environments for stablecoins and crypto assets.

Global Macro Trends and Crypto Adoption

While the USD remains dominant, a shifting global monetary regime might favor digital assets like Bitcoin. The document suggests Bitcoin and other digital stores of value could play a significant role in an emerging multipolar world order.

A softer US economy and potential Federal Reserve rate cuts in the first half of 2024 could present a favorable macro backdrop for cryptocurrencies.

Institutional and Retail Participation

Approximately 59% of participants in a recent Institutional Investor survey expect their firm’s allocations to the digital asset class to increase over the next three years. However, there is notable regulatory uncertainty, especially in the US, which is perceived to threaten the country’s leadership in financial services. Despite this, the regulatory foundation is expected to continue building, leading to more clarity and greater institutional participation in the future.

a16z crypto Outlook

Original report: https://a16zcrypto.com/posts/article/a-few-of-the-things-were-excited-about-in-crypto-2024/

Why Decentralization Matters

Decentralization matters because it allows for credibly neutral, open infrastructure, promotes competition and diversity, and gives users more choice and ownership. However, achieving true decentralization at scale has been difficult when competing against efficient centralized systems. Web3 and DAOs have provided a “living laboratory” to develop best practices, including decentralization models that support richer features and governance approaches that hold leadership accountable. As these models evolve, we should see unprecedented decentralized coordination, functionality, and innovation levels.

The Importance of Open Source

Open-source modular tech stacks are important because they:

-

Unlock permissionless innovation and allow participants to specialize, leading to more competition. The biggest advantage of an open-source, modular tech stack is that it incentivizes more competition.

-

Strengthen network effects rather than fragment them. Modularity that extends and strengthens network effects makes sense, especially for open-source projects.

-

Allow for deep integration and optimization across modular boundaries, leading to greater performance initially. However, the open-source modular approach has led to more innovation over time.

-

Decentralize and democratize systems rather than concentrate power and control with a few entities. Open source helps counter the issues that arise when control of a powerful system or platform is in the hands of a few.

Advancements in Verification and Security

The growing importance of formal verification in software, particularly in the context of smart contracts, reflects the increasing need for reliable and secure digital systems. New tools and methodologies make formal verification more accessible and effective, promising higher security and robustness in software development.

SNARKs represent a significant advancement in verifying computational workloads, offering a more scalable and practical solution for various applications. From edge devices to content authenticity and IRS forms, SNARKs are set to become a mainstream tool for ensuring the integrity and reliability of computational processes.

Appendix

About the Source Companies

Messari is a prominent platform, offering extensive crypto research, data, and analytics tools.

VanEck is a global investment firm with a focus on providing investors access to opportunities across emerging industries, asset classes, and markets with a variety of investment vehicles, including ETFs, mutual funds, and institutional funds.

Pantera Capital was the first U.S. institutional asset manager focused exclusively on blockchain technology.

Coinbase Institutional positions itself as a trusted bridge to crypto markets for institutions, offering a comprehensive platform for various investment stages, including trade, custody, and participation.

a16z crypto is a specialized branch of the larger a16z venture capital firm, specifically tailored to invest in the cryptocurrency and blockchain space.

Odos is a leading DeFi aggregator and intent solver who recently celebrated 1M+ distinct users and $16B+ in transaction volume. Odos’ proprietary optimization algorithm finds users the most efficient routes for their everyday DeFi actions, delivering them unmatched value.

Disclaimer: This document, provided by Semiotic AI, Inc., is for informational purposes only and does not constitute financial, legal, or investment advice. All content is provided “as is” with no guarantee of completeness, accuracy, or timeliness. Investing in digital assets and securities involves significant risk, including potential total loss of principal. Semiotic AI, Inc. expressly disclaims any liability for any loss or damage arising from the use of this document or its contents. Readers are advised to seek independent professional advice before making any financial decisions. Past performance is not indicative of future results. All trademarks and logos referenced herein belong to their respective owners. This disclaimer is subject to change without notice.